The heart of the Cooperative Compliance Programme

On 1 July 2020, legislation has come into force in Poland that implemented the possibility of running a pilot of a cooperative compliance programme under the name Cooperative Compliance Programme.

The regulations governing the operation of the Cooperative Compliance Programme are contained in Section IIB of the Tax Ordinance Act.

The Cooperative Compliance Programme is a form of cooperation between the National Revenue Administration and large entities, based on mutual trust and understanding as well as transparency beyond statutory obligations. The aim of the Programme is to undertake joint actions aimed at ensuring compliance with tax legislation with particular attention paid to the individual needs and expectations of key taxpayers in order to ensure better conditions for economic activity in Poland.

Under the Programme, the National Revenue Administration will provide an individualised service tailored to the individual taxpayer and will adapt its level of supervision and monitoring of the taxpayer to the measures the taxpayer has implemented to supervise its internal processes, including supervision of tax matters.

Horizontal monitoring, unlike a tax inspection, is not a direct supervision of the correct enforcement of tax obligations, but a supervision of the taxpayer’s internal schemes implemented by the taxpayer in order to correctly comply with the taxpayer’s tax obligations. The taxpayer will, in principle, audit their own accounts and the tax administration will supervise the taxpayer’s internal audit schemes.

Such a model of cooperation with the taxpayer has already been implemented in dozens of countries, including the Netherlands, Spain, France, Austria, the USA and Australia.

Programme values

- Mutual trust (NRA towards the taxpayers and taxpayers towards NRA) – it is a reasonable belief that the partner will act in accordance with the agreed principles.

- Mutual transparency – it is the willingness and ability of an applicant entity or entity covered by the Programme and NRA to openly communicate about tax issues. Transparency on the part of NRA means openness in terms of information about the circumstances surrounding questions addressed to the taxpayer and in terms of implementing supervisory actions towards the taxpayer.

- Mutual understanding – it means knowing the positions and interests of both parties. Understanding implies that the parties consciously cooperate in the common interest, which is the correct fulfilment of tax obligations.

Applying to the Programme

Participation in the Programme is voluntary and it is initiated by the interested entity.

The desire to participate must be expressed by the taxpayer in writing.

Stages of the Programme

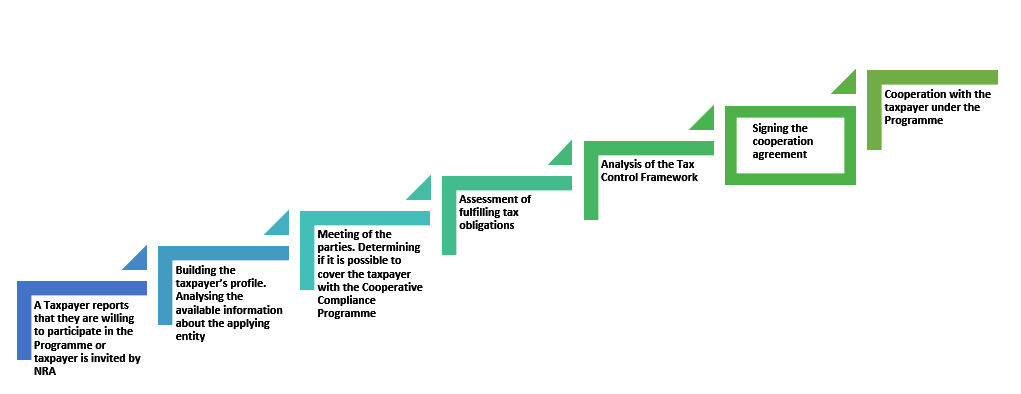

The Cooperative Compliance Programme has two stages:

- the onboarding process, which ends with the signing of a cooperation agreement

- the supervision of the taxpayer under the Programme.

Show the text version of the graphic: Operating process of the Cooperative Compliance Programme

Operating process of the Cooperative Compliance Programme - text version

- A Taxpayer reports that they are willing to participate in the Programme or taxpayer is invited by NRA.

- Building the taxpayer’s profile. Analysing the available information about the applying entity.

- Meeting of the parties. Determining if it is possible to cover the taxpayer with the Cooperative Compliance Programme.

- Assessment of fulfilling tax obligations.

- Analysis of the Tax Control Framework.

- Signing the cooperation agreement.

- Cooperation with the taxpayer under the Programme.

Once signed, the Tax Control Framework is monitored to verify that it is still effective and appropriate to the size and complexity of the entity’s organisational structure. As a result of the monitoring carried out, an adjustment is made to the individual plan of supervision of the fulfilment of tax obligations by adjusting the scope and frequency of supervision to the level of internal audit implemented by the taxpayer.